Big tech platforms are vying to keep creators in line to better connect with users.

But creators once at the mercy of these platformers are now looking for ways to more directly monetize their posts and get more for their money.

These creators are broadcasting the state of soaking in the jacuzzi, "game commentary" that distributes the scenery of game play, analysis of a little interesting neta (internet meme) on the net for a fee, sales of foot photos, etc. We are looking for new monetization methods. From app-specific editorial tools to multi-channel analytics to merchandising tech, a thriving ecosystem of startups is emerging to serve this demand.

Nihon Keizai Shimbun has a business alliance with CB Insights (New York), which investigates and analyzes the trends of startup companies and venture capital investing in them. We translate the company's reports on startups and technology into Japanese and publish them twice a week in the Nikkei electronic edition."On the Internet and on the video posting site 'YouTube', there is no advertisement in the video, and there is anxiety that the channel may be canceled. For this reason, creators are always looking for other ways to earn money. ”. YouTuber Joshua Wanders said in an interview with the New York Times (NYT): “I don’t know what will happen to me on these platforms.”

The “Creator Economy” is a large number of businesses launched by independent creators such as “Vloggers” who create video blogs, influencers, and writers to monetize themselves, their skills, and their works. Point. It also includes companies that support creators such as content creation tools and analysis platforms.

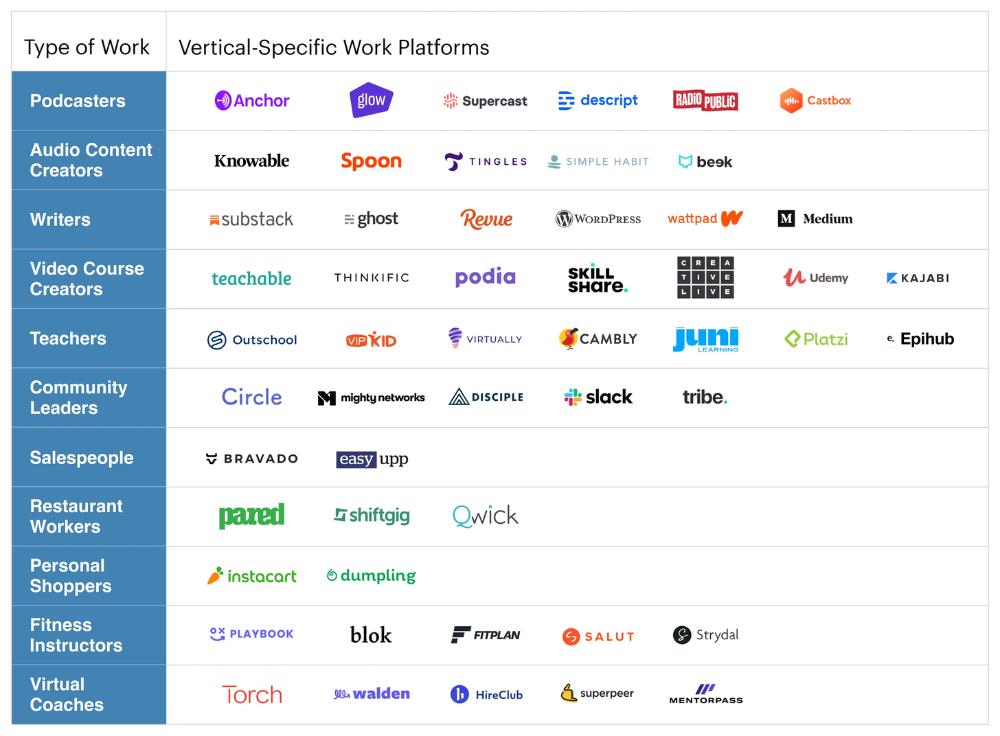

A thriving creator economy is fueled by tools that allow retail customers to monetize their work directly. The main ones include Ko-fi, a UK-based “tipping” service, Gumroad, a content sales platform in the US, Thinkific in Canada, which operates an online course creation platform, and Teachable in the US. An example.

This report looks at the creator economy and the opportunities it opens up.

The Creator Economy refers to self-employed businesses or side businesses started by self-employed people who earn income from their knowledge, skills, and fans.

While major social networks have made it possible for individuals to gather a large number of followers, until now there have been few, if any, ways to earn direct income (with the exception of YouTube, where creators are given advertising revenue). 55%, which the company has paid creators over $30 billion in the last three years).

The short video sharing app "Vine" (currently closed) was a precedent for this. The company was acquired by Twitter in 2012. At its peak in 2015, the company reached 200 million monthly active users and nurtured top creators such as Thomas Sanders, Zach King, and Shawn Mendes. But with the lack of direction for the service and the lack of infrastructure to support creators, creators left in large numbers.

In 2016, one of Bine's top creators complained to an American news site, BuzzFeed, that "three and a half years is too long to be posted for free." “Many top creators have found great success on YouTube, and now the wave of success is reaching Facebook.”

Influencers and creators are now full-fledged professions, and indirect monetization is no longer enough. Advertising deals are one-sided with brands, constrained, and fluctuate wildly from month to month. Moreover, creators are forced to target a wide range of demographics, making it difficult to specialize in niche fields or demographics. The fact that the main business base is free content also reduces the value of creators' works. Would your audience bother to pay for content they are accustomed to free? Against this backdrop, there are a growing number of relatively closed communities in which creators enclose their audiences.

Katherine Connors, co-founder and creator of Audio Collective, a community of audio creators, said in an interview with the NYT, "What we want to do is not just create models that change completely with audio. No. We want to promote a creator-led culture created by artists, creators, and talented people, not platforms and technologists.”

More new platforms are emerging that are now trying to replace the big social networks. These platforms recognize and pay for user-generated content. Top creators have become more influential in attracting users to new platforms, which has also contributed to platforms paying creators.

- Mail magazine distribution platform, American Substack writers receive 90% of the subscription fee.

・Partners (popular creators) of Twitch, a live game site, will receive half of the subscription fee.

· Creators of Patreon, a subscription-type crowdfunding that supports artists and others, get 88-95% of the support money.

・ Creators of paid SNS, UK only fans (OnlyFans) get 80% of the revenue as income.

It's clear that creators have a lot of influence and are shifting towards being able to monetize on their own. From major SNS such as Facebook, Instagram, US voice SNS "Clubhouse", to online media such as China's Bilibili, German SoundCloud, Twitter, US Medium, etc. Distribution platforms were very important in terms of audience acquisition. However, building an ecosystem with creators as founders has new possibilities.

Creators often have to juggle different tools to support different income streams. Existing B2B (for businesses) and B2C (for consumers) companies are not yet able to meet the needs of these micro-entrepreneurs. Consumer apps such as the Chinese video-sharing app TikTok have not yet established a billing system, and sales software HubSpot and customer service software Zendesk Enterprise tools don't cater to individual creators.

Companies have now realized the opportunity and are racing to keep creators on their platforms.

・Facebook CEO Mark Zuckerberg recently launched a shop where you can buy items worn by creators on Instagram, an affiliate (performance-based advertising) link, and a market that connects influencers with brands. The company announced plans to add a series of influencer tools, such as Places.

・Clubhouse recently embarked on measures to support voice creators, which will be the first monetization function, similar to Twitter.

・Twitter also started offering a function "Super Follow" that allows contributors with many followers to charge for limited tweets, and a function that can sell paid tickets for voice chat rooms.

・TikTok has already set up a marketplace that connects advertisers and creators within the app, and has created a $200 million creator fund.

・In addition to paying for advertising revenue, YouTube has also created a fund for creators. It has set up a $100 million fund for the creators of Shorts, a short video-sharing site akin to TikTok.

· Spotify (Sweden), a music streaming distribution service, has announced a policy of freeing fees until 2023 and collecting 5% after that in order to attract distributors to its podcast subscription service.

・Even companies like GitHub, a source code sharing service, have stepped up to help creators, offering services similar to Patreon's subscription tipping model.

On the other hand, various startups are trying to disrupt creators' content creation, audience development, and business expansion methods other than advertising. US-based video editing software Kapwing, US-based Cameo (company name: Baron App) that allows influencers to sell individual video messages for fans, US-based credit card company Karat Financial), the businesses of each company extend to content creation, monetization of interaction with fans, financing support, etc.

The value chain is extensive. In traditional employment, production, income, and benefits are bundled together, but creators operate in an environment in which these are disjointed. You have to collect various editing tools, different income streams, backend platforms, etc. yourself.

Creators leveraging CB Insights data to benefit from each stage of the creator work cycle, including content creation, off-platform monetization, and audience management Approximately 125 companies were extracted.

The map only lists unlisted surviving companies and is not intended to be an exhaustive list of companies in this sector. Some categories overlap.

The term "creator" is so broad that it includes anyone from hobbyists who sell PDFs as a side job to professional vloggers, and there are many ways to sell your work. It's hard to get the full numbers around the creator economy. There are about 50 million self-proclaimed creators, according to US venture capital (VC) Signalfire.

Creators are receiving funds from each platform.

・According to the US magazine Forbes, from June 2019 to June 2020, YouTube channels with the highest number of views reached $211 million.

・High-profile Instagram influencers such as Huda Kattan and Eleonora Pons earn up to six figures (hundreds of thousands of dollars) per post.

・Substack's top writer rakes in $1 million a year.

Gumroad creators have earned over $460 million in content sales since 2011.

According to influencer marketing agency Mediakix, businesses will spend up to $15 billion on influencer marketing in 2022.

In 21 years alone, a total of 1.3 billion funds were raised by companies for creators listed in the industry company collection (161 companies) compiled by CB Insights. $464 million, nearly triple the previous year's $464 million.

Rising investment in this space has led some companies to reach unicorn (unlisted companies valued at over $1 billion) or near-unicorn status.

Patreon: This membership platform recently raised $155 million in Series F funding, valuing it at $4 billion.

・Kajabi: The online course creation platform has raised $550 million in total funding, the most of any company on the market map. Enterprise valued at $2 billion.

· Kameo (company name is Baron Up): total raised $ 166 million, enterprise value $ 1 billion.

・Substack: Total raised $82 million, enterprise value $650 million.

・US VSCO: The corporate value of the photo processing app is 550 million dollars, and the total amount raised is 85 million dollars.

・US Splice: The enterprise value of the audio editing platform is $500 million. It has received funding from Union Square Ventures (US), True Ventures (US), First Round Capital (US), and Leller Hippo Ventures (US).

Traditional VCs are also poised to benefit. Diversified VCs and consumer-focused VCs have invested in well-known companies in the field, such as Substack and Patreon.

US VC Andreessen Horowitz is the broadest investor in CB Insights' collection of industry companies. It has invested in 18 companies, including music distribution company UnitedMasters, e-sports competition platform Lowkey, and community management service Beacons for creators. Second place and below were Union Square Ventures (11 companies), US CRV (9 companies), US Index Ventures, US SV Angel, US Social Starts, and US Thrive Capital (7 companies each).

There are also new VCs that specialize in the creator economy.

Atelier Ventures in the US, founded by Li Jin, is focusing on fostering creator communities through the community of business chat tool "Slack" and the database of creators on TikTok. The amount invested is 100,000 to 300,000 dollars, including Substack, creator fund management service Stir, and apparel company Luma.

Next Ten Ventures, founded by Benjamin Grubbs, is another VC firm specializing in this field. It has invested in video editing tool Trash, Star, and content creation platform Stage Ten in Canada.

As the top creators on each platform gather ever-larger audiences, the risk of over-concentration is emerging.

According to Ran Mo, former chief product manager of US game software giant Electronic Arts, Roblox, where users can play games created by each other, once in 2020, one-fourth of all users concentrated on one game.

The platform won't last long. Top creators are paid in the six to eight figures (hundreds of thousands to tens of millions of dollars), while most creators, known as the "middle class," make much less to survive. At OnlyFunds, the top 1% of creators control a third of all profits, while most earn less than $145 a month. Only 2% of Patreon creators made more than the US federal minimum wage in 2017.

Atelier Ventures' Li Jin points out that "platforms for creators thrive when they bring opportunities for growth and success to everyone." “By reducing the concentration of wealth, there is less risk of competing platforms poaching top creators and threatening the entire business,” he said.

Promoting the creation of diverse and wide-ranging content and supporting the prosperity of creators is a business opportunity for platformers. Journalist Craig Morgan, who was laid off from his employer in 2020, now has more than 1,000 people subscribing to his Substack newsletter for $5 a month, according to The Economist. paying. Not all creators make spectacular amounts of money, but they have the potential to make a living.

I'm familiar with the phrase about being able to get out of a job and become financially independent.

Gig economy companies such as ride-hailing company Uber Technologies Inc. and Lyft Inc. presented similar success stories, but even after several years of their emergence, there was still a heated debate over the pros and cons of being a gig worker. discussion is taking place. Gig workers complain that they are at the mercy of algorithms that they cannot control, and the predicament of being left behind with almost no conventional security due to the new coronavirus pandemic has become apparent.

Mr. Emily Reed, a writer in the web media "Real Life", commented on the reality of the rhetoric of self-monetization in the midst of the rise of creators and the boom of "non-fungible tokens (NFTs)", saying, "Overwhelmingly successful in investment. "There's always a near-zero chance of winning a game or grabbing stardom, but most of the time you'll just have to go for it."

In order to make the creator economy sustainable, Mr. Li argues that different strategies are needed, such as more funding for creators, a change in content strategy, and creator education.

However, even with the emergence of new tools, influential creators will eventually have influence, and the power structure of the platform itself will shift accordingly. Big name influencers and creators may gain the power to break free from the current big platforms, but what about the rest of the “middle tier” creators? Furthermore, will ``casual'' users and ``people who only read SNS but do not post'' be tempted to create content?

Similar to the rise of influencers and the gig economy, the shift to the creator economy has implications beyond financial returns for individual creators.

Journalist Jennifer Shaffer Goddard said at the US SNS study hall, "At least in order to be an online person, not someone who just reads and doesn't post, it's important to integrate other people's content with your own content. You need to get out of it and build your own avatar."

The creator economy is still in its very early stages. But investment in the space is on the rise, and investors and companies alike are paying close attention.

Internet media giants will look to offer more monetization tools to keep creators and their fan bases on their platforms. But creators don't like being tied to platforms, and are more likely to go independent brands to reduce their reliance on a single platform.

The development of the creator economy affects various industries.

・Fintech companies such as Karat Financial are paying attention to the fact that existing financial institutions do not have investment and loans for creators.

・As influencers shift to independent brands, retailers may find it somewhat difficult to contact top influencers and the cost of hiring them may increase. Ultimately, though, sponsorship deals won't go away anytime soon. E-commerce companies need to rethink their strategies and focus on the social element of shopping. This will likely take the form of limited edition collaborations that give creators more autonomy.

・Internet media must strengthen their own strengths to prevent the mass outflow of creators to other platforms. Income is key here. As seen in the giant tech creator race, this includes everything from creator funds to in-app monetization features. It may also include features such as content creation tools, moderation services, community and mentoring opportunities.

Unifying these various services for creators would be an industry-wide business opportunity. Along with the rise of content production companies and influencer marketing agencies, this burgeoning industry will see increased demand for comprehensive services that handle everything from content creation to analysis and management.

Mike Byenstock, founder of Semaphore, a US company that provides tax and other business services for YouTubers, said, "(YouTubers) are people who originally decided to start a business with abundant funds. No, it's mostly one-generation wealth."

Tools that support creators' unique brands and niche businesses will emerge as long-term winners. We will see more companies specializing in the needs of creators rather than a comprehensive service for all freelancers.